SUMMARY

Broker Network burnt over INR 280 Cr in less than 18 months, and founder Rahul Yadav is alleged to have built a web to syphon off funds from the company

With the company left with no money, more than 150 employees have not been paid since November 2022 and have run into personal financial troubles as a result of Yadav’s non-responsiveness

While Rahul Yadav says Info Edge blocked efforts to raise funds, the question is whether Broker Network merely had a bad business model or did wilful misconduct lead to this calamitous situation?

Sometimes it’s bad luck, sometimes it’s Rahul Yadav

After the Housing.com fiasco, the Intelligent Interfaces’ no-show, it’s time for Broker Network to feel the pain. Well, Broker Network is on the verge of a complete collapse, and Rahul Yadav is the key host of the show.

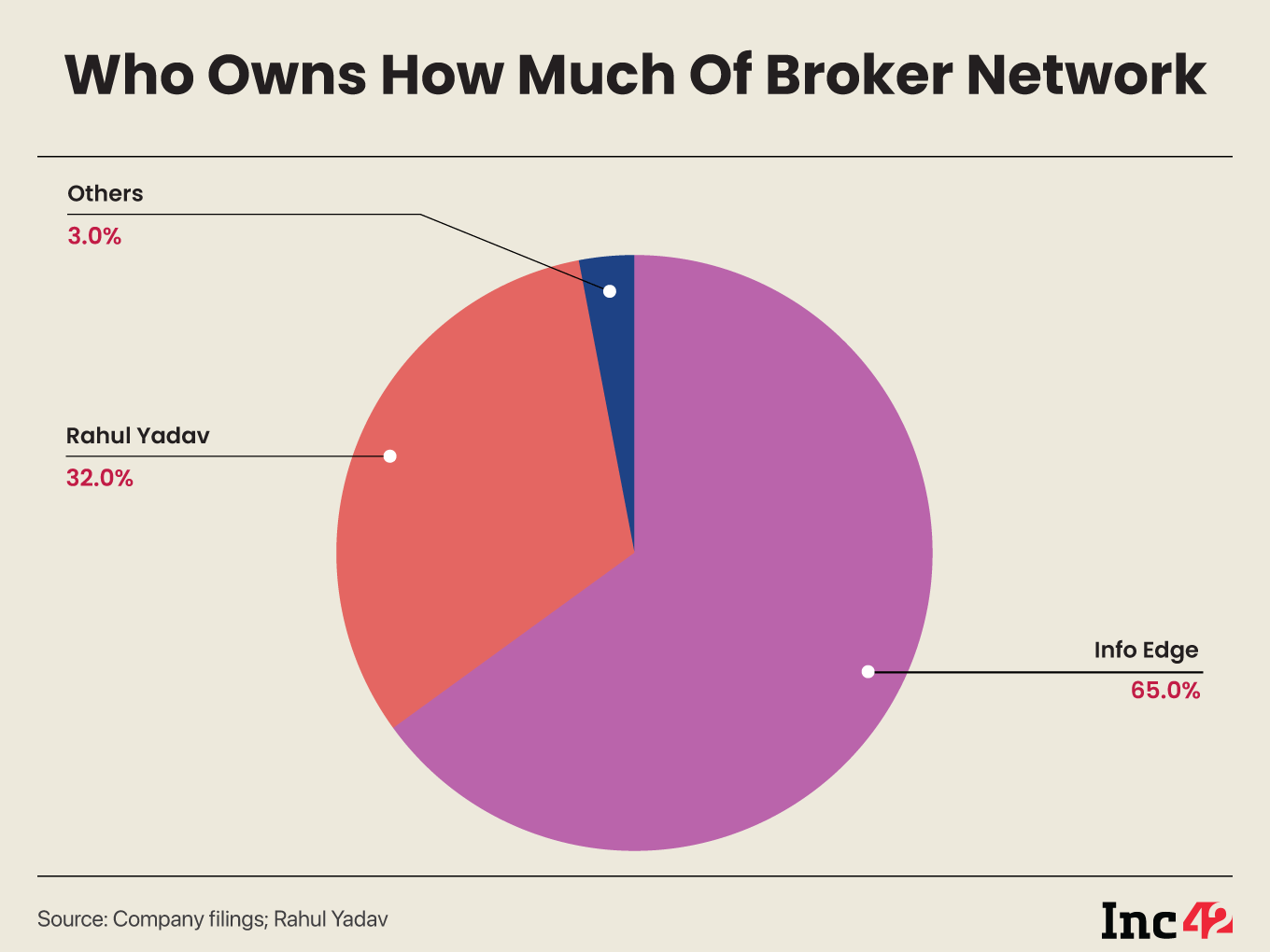

At a time when its lead investor Info Edge, with a 65% stake, has written off its INR 280 Cr investment in majority shareholder and initiated a forensic audit, the shaky company can crumble any day like a house of cards. Inc42’s months-long investigation shows that Yadav has nearly taken another startup to its doom.

Based on information gleaned from sources within the company, its vendors, people close to Info Edge and regulatory filings, it looks like Broker Network is perhaps the worst stint of Yadav’s largely questionable track record as an entrepreneur.

In the age of fallen founders such as Ankiti Bose, the GoMechanic quartet, and Ashneer Grover — to name a few — this is the story of the original Enfant terrible of the Indian startup ecosystem.

How Rahul Yadav Broke Broker Network

The troubles at Broker Network (operated by 4B Networks Private Limited) were reported soon after the Info Edge write-off in February, but there was much more under the surface.

Unlike Housing.com and Yadav’s other ventures, Broker Network’s story is about a worrying financial tangle, involving outstanding dues to several parties and an alleged illegal transfer of funds from Broker Network to two other companies linked to Yadav and his wife, Karishma Singh.

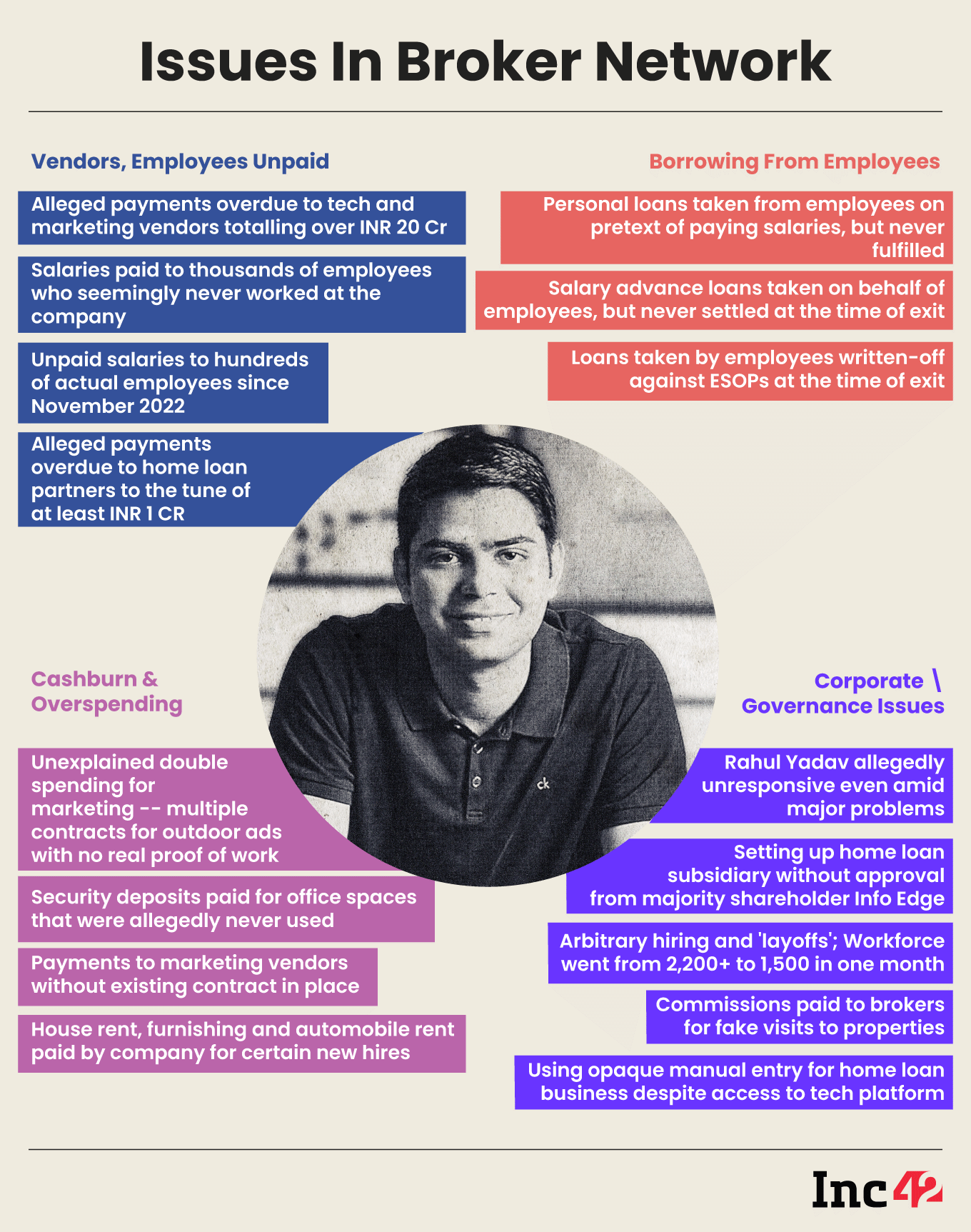

Before we prepare to delve deeper into the larger story, here’s the gist of everything that has allegedly gone wrong at Broker Network:

Besides this, we also found that the INR 280 Cr-plus infused by Info Edge and other venture debt investors has somehow simply vanished from the company.

Speaking to Inc42, Yadav denied all allegations related to any wrongdoing at the company. He told us that the company can be salvaged if Info Edge (which holds reserved matter rights) revokes some of the conditions placed on him to raise further funds.

Despite Yadav’s claims of Info Edge’s interference, more than a dozen employees at Broker Network told Inc42 that the situation would have been better had the company not overspent.

They further alleged that Broker Network’s funds were routed to Yadav’s holding company, RY Advisory. From there, the funds were further channelled to Kult App, a company where Yadav’s wife serves as a director.

A person close to the Info Edge leadership told Inc42, “Supporting him was an error in judgement. A leopard cannot change its spots.”

The holes in any startup’s business model can eventually be fixed but not the wilful malpractice of its founder, the above source added.

In the past few months, several criminal complaints have been filed against Yadav and others at the company. These are currently being investigated by Mumbai Police as well as other law enforcement authorities (more on these later).

Our story will look into how Broker Network crumbled, but it’s also a story of how employees are caught in the middle, with many awaiting salaries since September 2022. Many of these employees are saddled with personal loans and left with little recourse but to fight a social media battle.

Before we dive into this story, a short sidebar: this is not just about one company — it’s about a pattern that’s become all too common in the Indian startup ecosystem. With yet another firebrand personality added to the mix of Indian founders that crossed the metaphorical line, will this incident spur changes and initiate stricter action against bad actors?

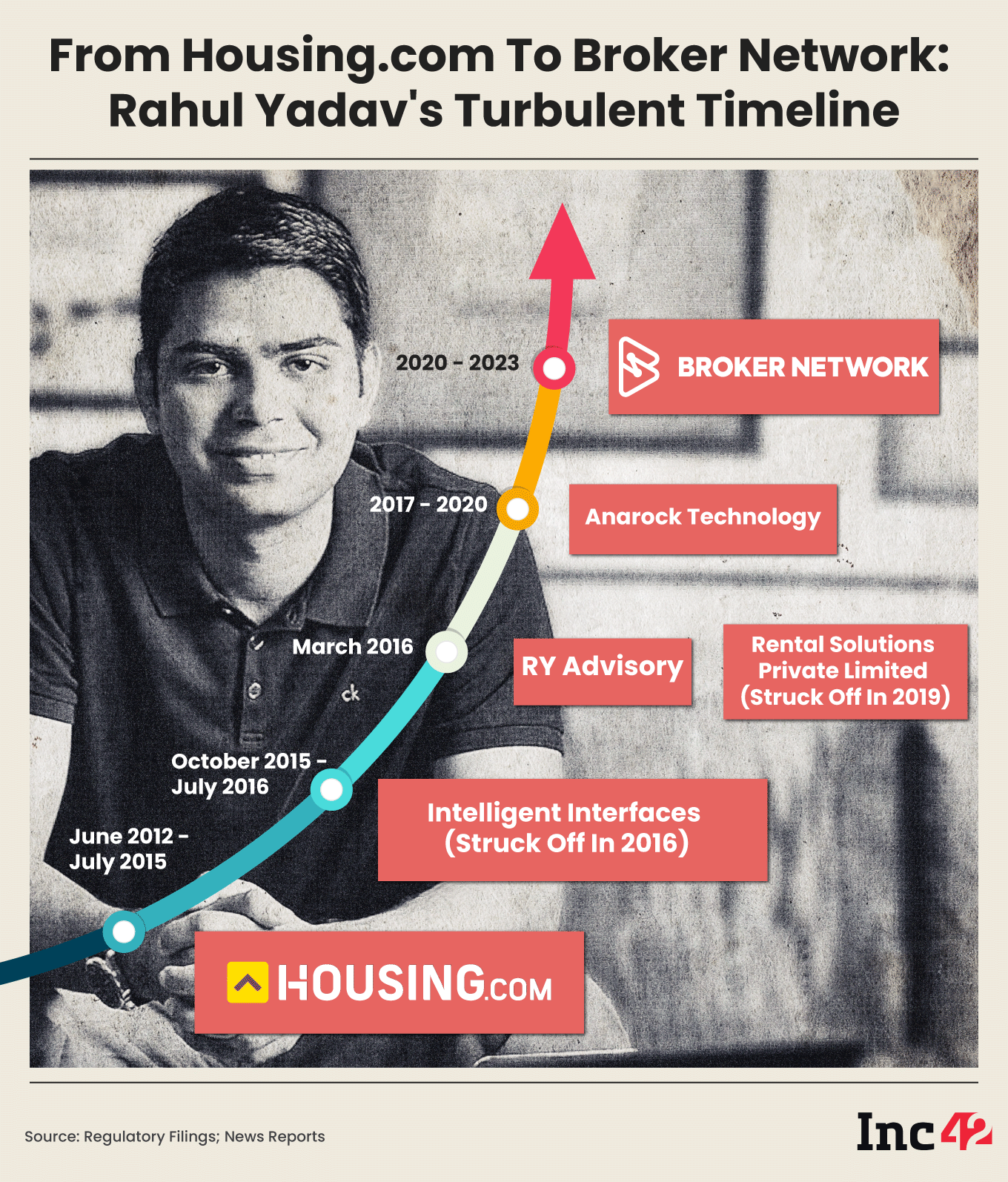

Life After Housing.com: Rahul Yadav’s Chequered History

Less than a decade ago, Yadav was considered a role model for Indian entrepreneurs and seen as a maverick who would change the tech industry. His fall from grace has been well documented, with Inc42 leading the coverage at the time.

But in the world of startups, VCs tend to have a goldfish-like memory and even after the Housing.com debacle in 2015, Yadav was courted by investor money twice.

His reputation of being brash and a young ‘IIT Bombay dropout’ who could raise millions of dollars from SoftBank easily preceded the man himself.

And the investment from Info Edge, which has backed some of the most successful startups in India, brought a lot of confidence to the table despite Yadav’s track record.

Rahul Yadav’s entrepreneurial journey shows a pattern of starting companies, raising funds and then shutting them down (in a year or two). It’s the kind of ‘resume’ that should have certainly attracted questions from Info Edge or other investors that backed him.

Now, two years after its inception, Broker Network is all but dead in the water. Its business is in disarray.

In late April, disgruntled employees not only managed to take down the tech platform by revoking access to all their work but also brought union leaders to the company’s office to recover their salaries.

So, what led to this calamitous situation?

The Leaks In Broker Network’s Ship

The clue to Broker Network’s business model lies in the name of the parent entity. 4B Networks Private Limited hints at the four ‘Bs’ that Yadav wanted to connect through this platform — buyers, brokers, builders and banks.

The company started out with a product to solve property discovery, connecting potential buyers with property builders through a network of brokers. These brokers received a commission for buyer visits from developers who would pay the company on a per-visit basis.

While the home visit business was also faltering due to a spate of ‘fake visits’, a problem that was previously reported by The Morning Context, the lack of transparency on the home loans front was an even bigger problem.

For home loans, Broker Network registered itself as a direct selling agent (DSA) and also signed up other DSAs as partners to bring in business. DSAs are generally middlemen that partner with banks to extend loans, thereby receiving commissions (as high as 1.25% on the loan amount) for their services.

This commission is further split between DSAs and brokers, usually in a 60:40 ratio, according to sources who have worked on the home loans tech product.

Sources also claimed there was resistance from the home loan business team in transitioning to a tech-enabled platform because this would mean increased transparency. Employees we spoke to alleged that the team wanted to continue using manual entries to record home loan approvals and commissions to brokers, which was a huge red flag.

“It’s not easy to convince a broker to leave one DSA because many have favourable commission splits with their preferred DSAs. Broker Network decided to undercut the whole market. If others were giving roughly 40-50% of the bank commission, we were giving more than 75%-80% in some cases. It was impossible to run the business sustainably on that thin margin,” said one of the sources, a former director of the company.

At least one DSA — Finqy — that Inc42 has spoken to claimed that Broker Network was even offering the full commission received from the bank in some cases. Finqy’s founder Manish Aggarwal told Inc42 that Broker Network owes his company more than INR 1 Cr.

In April, Finqy filed a criminal complaint against Rahul Yadav, Pratik Chaudhary (director at the company) and Broker Network in the Goregaon East police station. The investigations are underway. Yadav and Chaudhary have already dishonoured summons by the authorities and if the duo miss another one, an FIR will be filed against them, as per Finqy’s legal representative.

Meanwhile, Yadav declined to directly address this particular police complaint, claiming that he gets several such emails from vendors and employees.

Opaque Operations And Mysterious Hiring

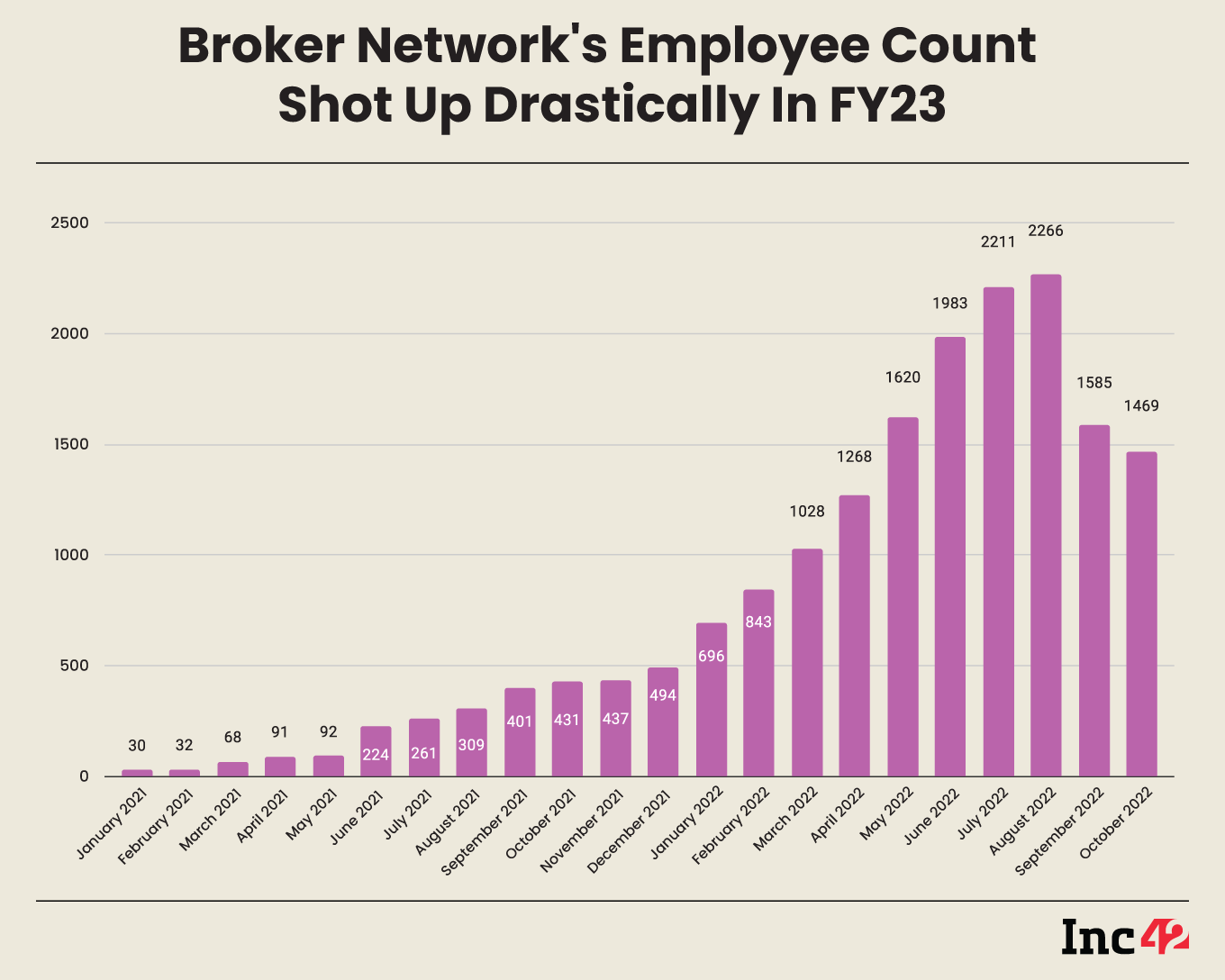

Broker Network’s problems began in August 2022. Saddled with huge employee expenses, the company returned to Info Edge for funds. This is when Info Edge began asking questions about the need to have 2K+ employees.

Broker Network’s peak employee count was close to 2,300 in July 2022, but it then suddenly dropped to under 1,600 in a month.

One high-level employee, who served Broker Network as a director, alleged that the management had then told Info Edge that it would let go of 400 employees, even though no such development actually occurred in the company.

These allegedly dubious ‘layoffs’ correspond to the period when Broker Network suddenly saw a drop in its EPFO deposits.

It was also around this time (August 2022), Yadav turned to his long-time employees to borrow personal loans to pay employee salaries. One such top-level employee lent close to INR 50 Lakh to Yadav. He has filed a criminal complaint against Yadav.

Other employees were also asked to take ‘advance salary’ loans and transfer the amount to Yadav. Now, since many of these employees are no longer employed at the company, these loans have become personal liabilities for them.

Employees alleged that all through this, Yadav maintained a luxurious lifestyle. Addressing this, Yadav told us luxuries such as his Maybach came from his earnings at Anarock. “I was also looking to buy a Bentley,” he added.

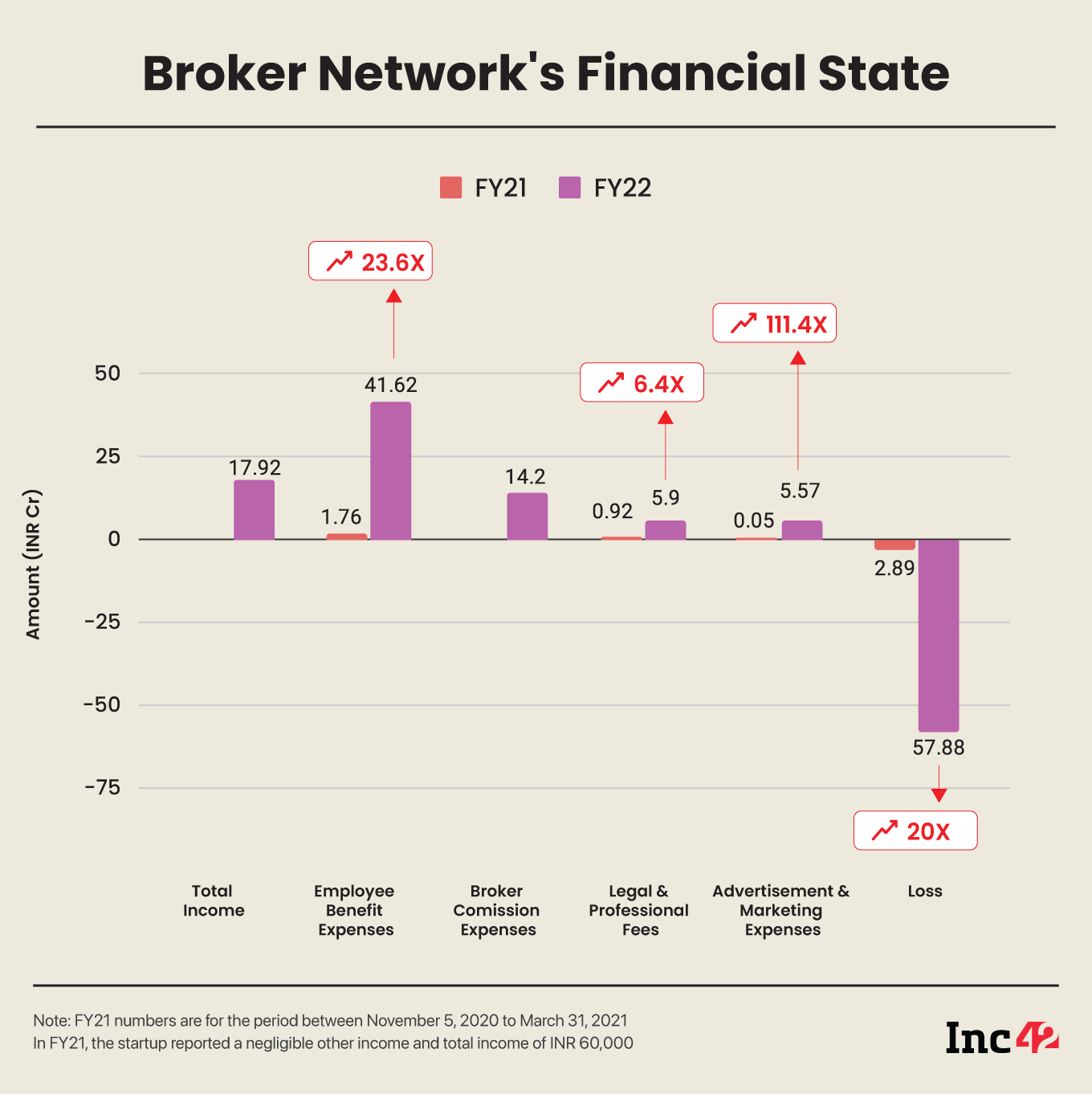

Some clue to the absolute disarray is seen in the financials of Broker Network. The company has shown in its FY22 results that employee costs for the whole year were INR 41 Cr, including gratuity and tax costs. But as per Info Edge’s email in January, this shot up to INR 20 Cr per month or INR 240 Cr for the first eight months in FY23. It is unclear just how the company was able to sustain this run rate.

Employees allege that roughly INR 9 Cr was being spent per month on the ‘home visits’ business and around INR 18 Cr to INR 20 Cr on the ‘home loans’ front. This amount includes operational and employee expenses we were told, so the monthly burn was just over INR 30 Cr by most estimates.

Yadav told Inc42 that even though he is the CEO of the company, his management style involved delegating a lot of work and trusting his employees to do the right thing.

“I honestly do not read many of the documents that come to me for signatures,” Yadav claimed.

He also insisted that he was largely unaware of the financial transactions at the company when pressed for answers about the high cash burn.

It’s not just employees but also vendors that are yet to be paid by Broker Network since last year. Inc42 has seen emails and text messages from vendors such as software development company NeoSoft, advertising agency Interspace Communications and home loans agent Finqy that show more than INR 20 Cr is yet to be paid by Broker Network.

Many other vendors are reluctant to come forward due to the fear of losing out on whatever dues the company owes them. And amid all this, employees allege Yadav has disappeared, leaving other executives to answer their concerns.

Speaking with Inc42, Yadav insisted that Info Edge has blocked all attempts to raise funds since February, citing the reserved matter rights in the shareholder agreement. Yadav said he was confident about raising further funds, given that he had lined up investments in early 2023, which were not approved by Info Edge.

Sources close to Info Edge told us that as a lead investor, it holds the right to approve or reject fundraising proposals. In this case, Yadav looked to raise debt at exorbitant interest rates and there was no formal business plan to repay the debt, the sources alleged.

We were also told that Info Edge would have accepted fundraising proposals as long as due diligence was conducted with the investors, which never happened.

Employees To Rahul Yadav: ‘Where Are The Millions?’

“You tell me where Rahul Yadav is. It’s been 18 months since the company began operations, but I have seen him less than 18 times in the office. He usually hires a boardroom at the Taj Land’s End for INR 80K per day and conducts all his meetings there. No one knows what happens there,” an employee, instrumental in developing Broker Network’s tech platform, told Inc42.

On his part, Yadav denied this allegation but didn’t refute the cash crunch at the company.

Further, Info Edge was aware of the liquidity problems in its portfolio company.

An email from Chintan Thakkar, the chief financial officer and executive director of Info Edge, exhorted Yadav to explain what was being done to solve the situation.

The email, sent on midnight January 01, 2023, said the company was sitting on INR 140 Cr in receivables (as of November 2022), or ‘7X the monthly wage bill’. Thakkar also asked the CEO for a plan to collect this revenue.

While Yadav did not respond to the email, he told us that efforts were on to collect a portion of these receivables, but the issue at hand is that many vendors that owe the company have stopped responding.

“Info Edge’s reserved matter rights are the major source of the problem when it comes to settling employee dues. If they (Info Edge) allow me to raise funds, I would be able to pay everyone and save the company,” the CEO said.

Financial Disarray At Broker Network

Many employees are also said to have departed the company after signing contracts that ended their employment, with a promise of a staggered payout against their outstanding salaries. However, these employees do not know whether they can legally challenge any delays or lapses in these payouts.

The question then is whether Broker Network has any funds to pay these salaries at all?

According to filings, Broker Network had just over INR 40 Cr as cash and cash reserves at the end of FY22. Besides this, it had over INR 80 Cr in deposits which were said to have a maturity of less than 12 months as of March 2022. Further, it had trade receivables to the tune of INR 16 Cr in the FY22 numbers, which ballooned to INR 140 Cr by November 2022.

Essentially, the company did not lack funds, at least at the beginning of FY23. Yet, somehow by August 2022, Broker Network was more or less broke, when Info Edge infused another tranche.

As per filings, the company saw another INR 90 Cr infusion from Info Edge in September 2022. Filings show Broker Network also raised INR 15 Cr as debt from Delhi NCR-based N+1 Capital, and another INR 5 Cr from InCred Financial Services.

Stride Ventures was close to investing INR 12 Cr in the company but a company’s spokesperson said this got rejected after due diligence.

Still, Broker Network had INR 110 Cr ($13 Mn+) with these new infusions in late 2022. Where did these millions go, employees are now asking.

Employees have laid several allegations at the feet of Yadav.

- They allege that even as Broker Network empanelled a reputed vendor for the outdoor advertising (name withheld) in Pune, it also signed another contract with NSE-listed Vertoz Advertising Limited for a similar campaign in Mumbai

- Vertoz did not have any background in outdoor advertising, yet Broker Network paid it INR 11.8 Cr

- Other areas of overspending: Splurging on a coworking space in Mumbai’s Andheri, with INR 15 Cr in security deposit and INR 1 Cr per month in rent. Yadav claims this was because INR 9 Cr was a security deposit for office interiors and each seat at this workplace cost INR 12,000 every month

- Huge employee costs: As much as INR 20 Cr per month from April to November 2022, which Yadav called normal for a company growing at a rapid pace and with a long product roadmap. Notably, products such as invoice financing or a tech-driven home loan platform did not pan out due to the lack of funds

But there is more to this story.

The ‘Kult’ Connection

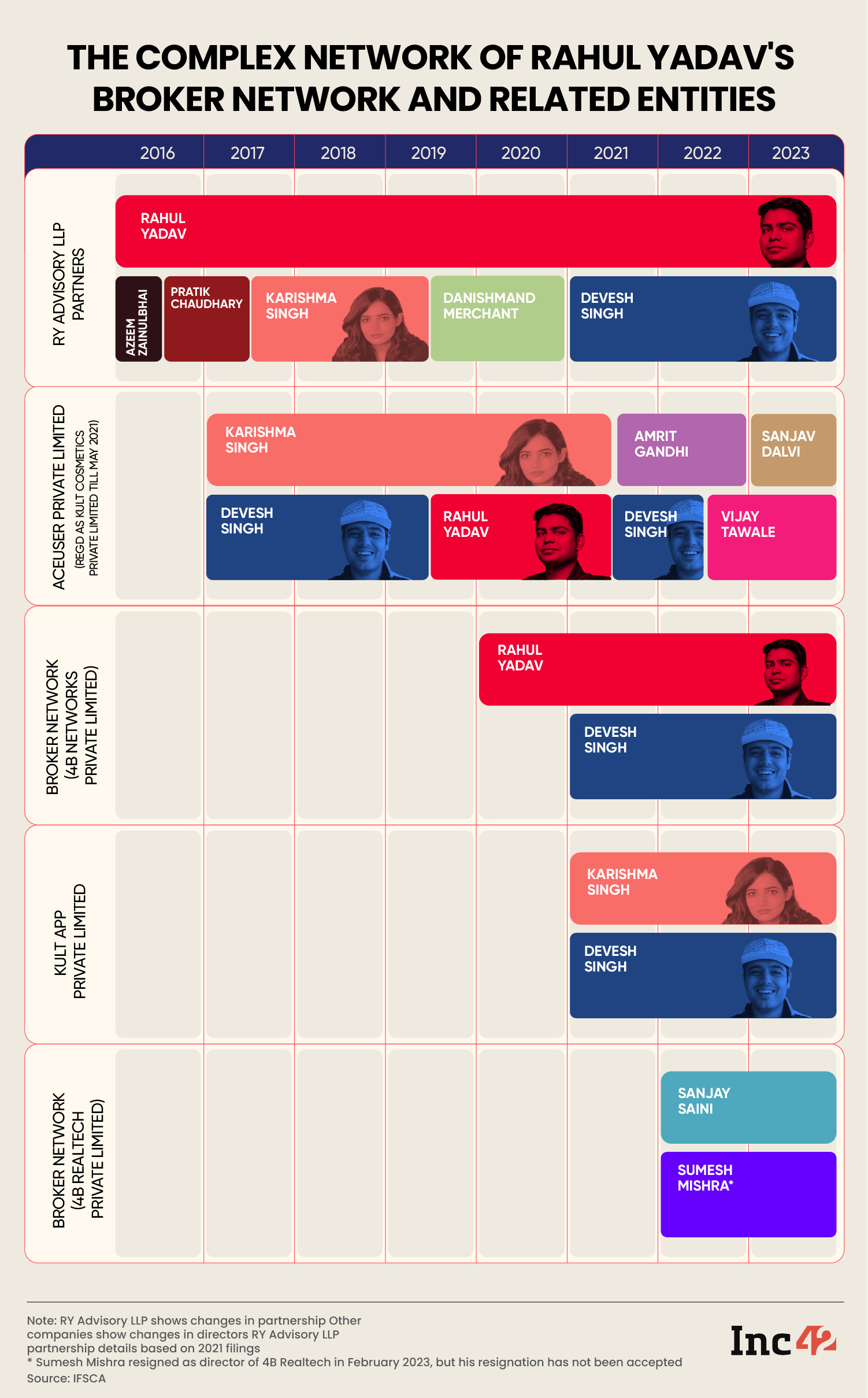

The Broker Network story goes beyond revenue leakages or employees questioning how millions of dollars of funding just vanished. It is, without a doubt, a complex web (see graphic below) that Yadav has created over the years.

In a bid to untangle this, we will have to understand how Yadav’s RY Advisory LLP played a role in allegedly syphoning funds from Broker Network.

For one, the other director of Broker Network, Devesh Singh, Yadav’s brother-in-law, earned almost 3X what Yadav was paid (INR 81 Lakh vs INR 29 Lakh) in 2021-22. Besides, the duo also took loans to the tune of INR 60 Lakh, as per Broker Network’s FY22 filings.

Many employees alleged that Devesh, also a director in Kult, was on the company’s payroll solely due to his personal relationship with Yadav and had minimal involvement in Broker Network’s day-to-day operations.

However, according to Yadav, Devesh was instrumental in developing features for Broker Network, though he did not elaborate on what these features were.

Incidentally, Sumesh Mishra resigned from 4B Realtech on February 3, 2023. But this resignation has not yet been accepted by the company for reasons unknown.

Kult also saw a curious director appointment in 2021 when Amrit Gandhi joined its board. Gandhi, who has a background in real estate, is also a partner in Amrfina Construction LLP with Danishmand Merchant.

Notably, Merchant served as a partner at Yadav’s RY Advisory between 2019 and 2020. So, Kult and RY Advisory’s key decision-makers had some connections.

Employees allege that this is the link that points to funds being moved from Broker Network to Kult via RY Advisory — although this can only be proven if one looks at the bank account statements of these companies.

However, what we know is that RY Advisory and Yadav pumped several crores in Kult. In FY21 alone, Yadav invested INR 7.5 Cr, while RY Advisory separately infused INR 11.7 Cr.

Then there’s 4B Realtech Private Limited, which, according to Yadav, was set up to acquire an NBFC licence for a lending business. 4B Realtech was not a step-down subsidiary of 4B Networks, but a separate entity.

4B Realtech was given a loan of INR 7 Cr by 4B Networks from bailout funds received by the latter from Info Edge in January 2023.

“Info Edge gave Broker Network INR 12 Cr to pay vendors and employees partly, and partly as a loan for 4B Realtech, but this was conditional on all dues being settled. Instead, the money was transferred to 4B Realtech without any dues-cleared certificates. This was the biggest reason for the write-off,” a source close to the leadership at Info Edge told Inc42.

Further, the change in the name of Kult’s parent entity, Kult Cosmetics, to Aceuser is also curious.

Aceuser does not really have any meaning unless one looks at Danishmand Merchant’s other companies — Ace Links and Ace Housing & Construction. In this light, it’s hard to unsee a connection between Merchant and Kult, where Yadav was also once a director.

Is this just a coincidence?

Possibly. However, there are transactions that further link Rahul Yadav and Merchant — particularly with three separate leave and licence agreements for office properties in Bandra. These were rented by Broker Network from Merchant and his company, Ace Links, with an attached refundable security deposit of INR 7.5 Cr.

These were signed in 2021, but multiple employees claimed that in October 2021 Broker Network moved to a coworking space in Andheri and then again to another office in September 2022. Employees alleged the rental agreements were for properties used very sparingly by just 15-20 employees.

Curiously, none of the leave and licence agreements had any mention of a monthly rent to be paid by Broker Network.

Yadav, however, claimed that these deposits were repaid to Broker Network, though the CEO did not share any proof for the same.

Rahul Yadav’s Facade Crumbles

The fact that Yadav raised funds from Info Edge might have told the ecosystem that the maverick entrepreneur may have indeed calmed down after the Housing fiasco, after which, Yadav was labelled everything from a prize idiot to a brash genius.

And it seems nothing has changed still. Even as an influential investor, there’s only so much that Info Edge could have done to remedy the situation once it went out of hand. “Even if Info Edge was on the board of directors, a founder who wants to dupe investors will do so. Just look at GoMechanic,” our source added.

Given this scathing review, it feels that Rahul Yadav may have finally exhausted any remaining goodwill in the market.

Now, the only thing left to see is if the potential collapse of Broker Network will end his mostly bumpy entrepreneurial journey, especially when the Housing.com fiasco still feels fresh.

Update Note | June 02, 2023; 12:20 PM

– Added mention of Sumesh Mishra’s resignation as director from 4B Realtech, which has not yet been accepted by the company

Correction Note | August 30, 2023; 6 PM

– An earlier version of this article erroneously mentioned that Vertoz ran an outdoor advertising campaign for Broker Network in Pune, when in fact this was in Mumbai. The error is regretted

– Inc42 has recently seen proof of campaigns run by Vertoz for Broker Network. We have removed the allegation from former Broker Network employees about lack of proof of work from Vertoz